When is the Right Time to Buy a Home?

Following skyrocketing demand for homes during the pandemic and climbing mortgage rates, many homebuyers who waited to buy are left wondering if there will ever be a “right time” to buy a home. But what if we told you buying a new DFW home despite current challenges is still a wise financial investment?

Here’s what you may not have considered if you’re trying to determine the right time to buy a home:

When should you buy a home? As soon as you have the down payment.

- As soon as you can afford the down payment, you are going to hold longer than 5 years, and as soon as you find the DFW home you like.

- Waiting is very expensive, as rents are appreciating.

The 4 greatest reasons to own a home in the US:

- You need a place to live, and the home is the only investment you can live in.

- The home can be leveraged greater than any other investment, for anyone that is not in the 1-10% top wealth brackets.

- Leverage of 90%+ and a down payment of 10%+, added to a 4% annual appreciation rate (estimated), will turn that 4% annual return on the down payment into an approximately 40% annual return. This leverage and return are not easy to match or beat.

- The gain on sale of your personal residence is tax free up to $500K (single filers $250K) of gains.

Use mortgage rates as a guide and not as the reason.

- Mortgage rates are a key instrument in housing and real estate.

- It’s a real deal, because the lower the rate, the more people can afford a home.

- In fact, we all feel wealthier when rates are low. So, when you choose to buy with lower rates at purchase time, you are likely buying in a seller’s market.

- On the contrary, when rates go up, and it becomes a buyers’ market, sellers reluctantly lower prices.

Example scenario – 3.5% rate versus 5.5% rate

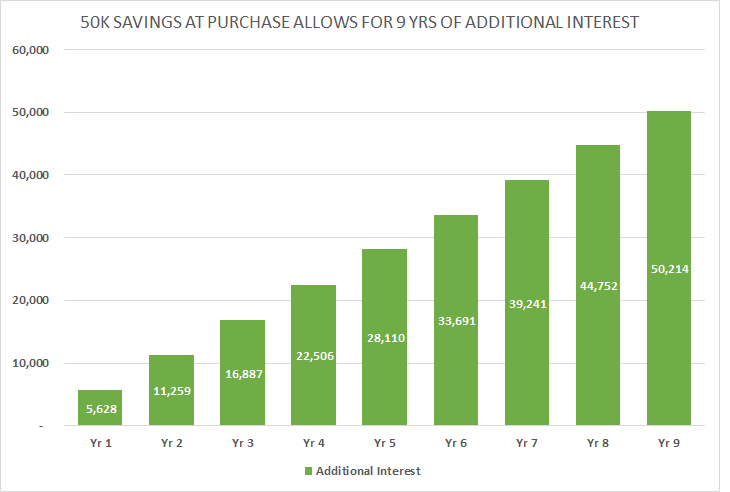

If you take a look at the example below, when you buy is not as important, because with the small discount coupled with appreciation you can easily outrun the extra interest. In fact, the example below shows that a 2% savings in interest takes 9 years to catch a $50k reduction in price. Last year, rates were low and prices were elevated. This year, rates are higher, and prices have been reduced or buyers incentivized. Let’s look at his example of two people who bought the same home in the same neighborhood a year apart:

- I purchased my home – 3.5% mortgage last year ($450K home 10% down) – so I’m better off!

- I purchased the same home for $50K less ($400K home with 10% down and 5.5% mortgage) – so I’m better off!

RESULT: after 9 years they are in the same spot!!!

If you take this one major opportunity to create real wealth and you say, “Nah, I’ll pass.” This is simply not financially wise unless you have another 40% plus tax-free investment option.

FIND A WAY

The freedom of renting and not having to get mortgage qualified or saving for that down payment are all factors. But like everything in life, if it was easy everyone would have already done it, and if the benefits are this great, don’t you think you could or should find a way?

Now is the right time to buy a home! Grenadier Homes builds space-efficient, single-story Villas and 2-story Townhomes in ideal locations across the Metroplex, including Mira Lagos in Grand Prairie, Woodbridge in Wylie, Meridian at Southgate in McKinney and Windsong Ranch in Prosper.

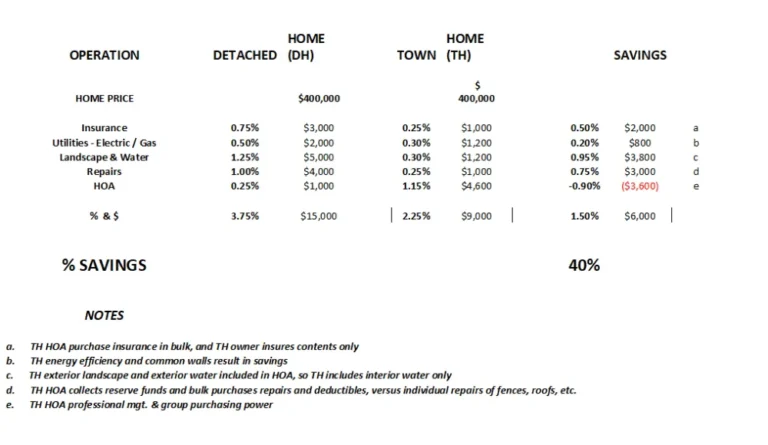

These unique DFW homes are an ideal investment: low cost-to-own, smaller floorplans that live large, lower property taxes and exterior property maintenance handled by the HOA. All Grenadier communities also feature fabulous lifestyle amenities including pools, dog parks, amenity centers, trails, a full calendar of community events and so much more.

Let Grenadier Homes show you how much value you can add to your life by moving into a new Villa or Townhome today!

*The example used is for illustrative purposes only. Actual investment and savings potential should be determined with a professional investment adviser.