6.5% Mortgage rate too high- Prefer 5%? If you choose a DFW Townhome over a Detached Home, you save $9k annually (1.5%) so you save that extra 1.5%

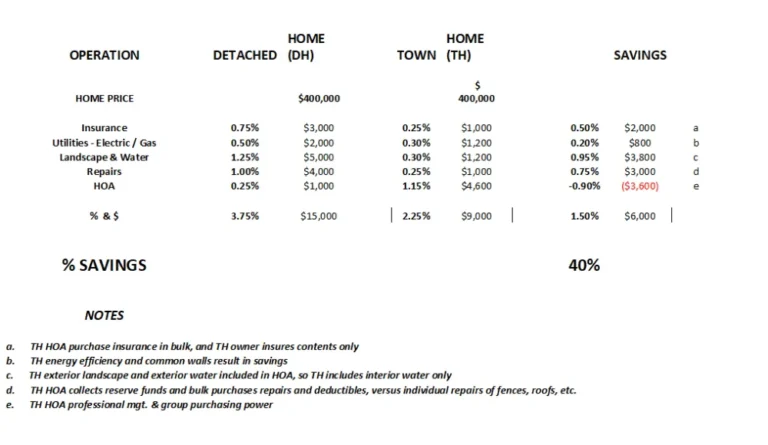

Mortgage rates fluctuate down then back up, affecting our purchasing power. However, seasoned homeowners and investors know a secret, that a townhome HOA saves you money. The chart below shows this clearly, as you save on Insurance, Interior Utilities, Lawn Care and Landscape, and Exterior Repairs.

That is 40%, $6000 annually, $180,000 in 30 years (non-compounded).

If your DFW townhome was an apartment building, it would sell at a capitalization rate. At a 5% cap, that is 20 times earnings, or $120,000 ($6k savings times 20) of the current value. At a 7% cap, that is 13.33 times earnings or approximately $280,000 ($6k savings times 13.33) of the value. The purchase market for individual homes has not yet computed this into value, so all DFW townhome owners are effectively getting this discount. This means, as the market figures this out, the owner of a townhome gets the value.

We all like our homes, but repairs are no fun, and especially dealing with contractors. Let the HOA do it. Your time has value too. This is not even part of this analysis.

The repairs savings of .75% or $3,000 will be much higher if the home is older. I would guesstimate an additional .5% for each decade of home age, assuming modest deferred maintenance.

This is why Grenadier Homes builds DFW Townhomes, as they are a very intelligent, financially-savvy way to achieve a better lifestyle. For many, this is the home of the future as our resources become even more strained.

Come see the 1-Story Villas and 2-Story Townhomes available at Mira Lagos in Grand Prairie, at Woodbridge in Wylie, and Windsong Ranch in Prosper. Grenadier builds high lifestyle townhomes focused on community, outdoor courtyards, and terrific architectural styling.

Located in Master-Planned Communities, a Grenadier Townhome is a unique lifestyle option, and a smart financial investment.