If you’re starting your DFW homebuying journey, it can be easy to get caught up in the emotional aspects of the process. Your home is your personal sanctuary, a place to reflect your personal tastes and a place for peace, relaxation and community belonging. This is where the right side of your brain can help you the most.

At the same time, your home is likely your greatest personal investment. A place where you can leverage your purchase with a high-leverage mortgage, securing the value of the home and thereby allowing you to live in the investment. This allows you the greatest personal source of investment profits and tax advantages. The left side of the brain can help you the most in this analysis.

This DFW homebuying blog explores the left brain, so let’s visit the principles from Warren Buffett and how he puts himself in the proper left-brain mindset:

THE BUFFETT MINDSET

- Approach it with a long-term mindset.

- Do not fear the market’s ups and downs.

- Research and reflect.

- Do Not follow the crowd.

- Do not fear life changes.

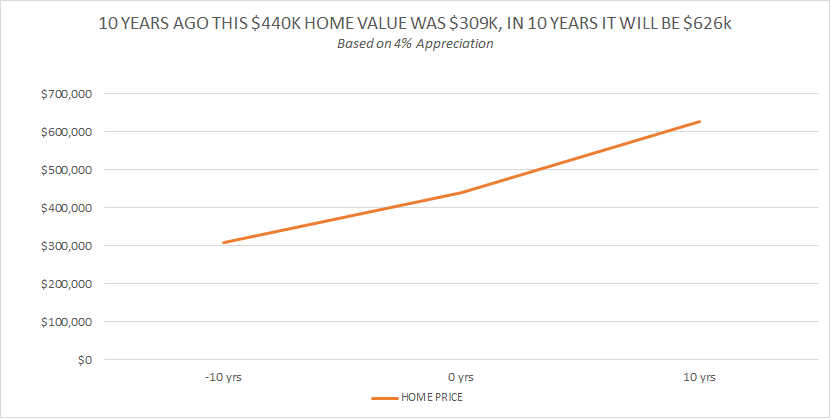

Now, Buffett spends a good amount of time contemplating before making the best decision. The reason is like most things in life, if you are too emotional or impulsive or fearful, you miss the opportunity or make a poor choice. If you play with preparation and confidence, you perform at your peak. If you look at home prices over time (see chart below), home prices in DFW increase on average 4% annually over the last 2-3 decades.

So, shouldn’t you think about buying a new DFW home as your primary long-term mindset? If you worry about the mortgage rates only, you will buy when they are low only. Well, when rates are low, more people can buy, so prices get bid up and a market frenzy happens. When rates are high, fewer people can buy, so prices get bid down. Mortgage rates are always fluctuating over time, so it is more important to buy the right home at a reasonable price and worry about getting the best mortgage at the time and refinancing it later if the rate is a bit higher than you like.

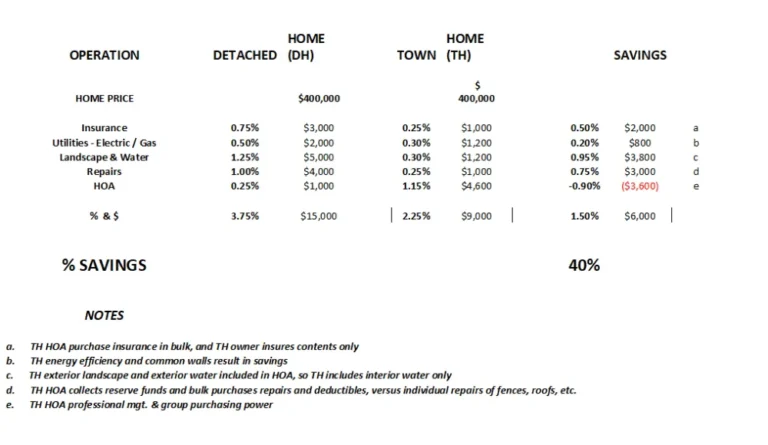

Research and reflection are always simple to say and difficult to do as we get excited and have emotional overload or information overload. That is why you should consider: your lifestyle, the neighborhood, the quality of the home, the builder and the reputation, the size of the home and its cost to own (and not just the principal, interest, taxes, and insurance), the features of the home, outdoor spaces, maintenance and benefits of a HOA, and the City and its tax rates and schools.

“Do not follow the crowd” is one of Buffett’s key strategies. Do you think he would have been buying in the midst of the frenzy in 2020/2021 when it was put your name on a list and no negotiations? Or, do you think he would be buying now as choices are more abundant and homes are incentivized for sale?

Buffett famously has said “when the price of hamburger meat goes down, in our family, we eat more hamburgers.” He remarked that the volume of stock purchases goes up when prices are going up, and he found this to be faulty thinking and poor investment logic. So maybe you should consider this as your DFW homebuying guide and buy when the choices and deals are more available.

Finally, do not over-worry if your life changes; you may be stuck in renter-by-choice mode. This costs you tremendous appreciation over time. If you buy and life changes, you have options. You can either sell for a profit, refinance, or even rent until the time is right to sell. If you like the home and made a good buy, you can be an owner longer term and make lots of money doing so (stay tuned for more on this in our next blog).

At Grenadier Homes, we build DFW townhomes at a lower cost to own in high quality locations. Check out our best-in-class, luxury 1-story villas and modern 2 story townhomes located in high-quality master-planned locations such as Windsong Ranch (Prosper), Meridian (McKinney), Woodbridge (Wylie) and Mira Lagos (Grand Prairie).

*The example used is for illustrative purposes only. Actual investment and savings potential should be determined with a professional investment adviser.