How to Instantly Lower Your Mortgage Rate? Choose a Grenadier DFW Townhome

Financial

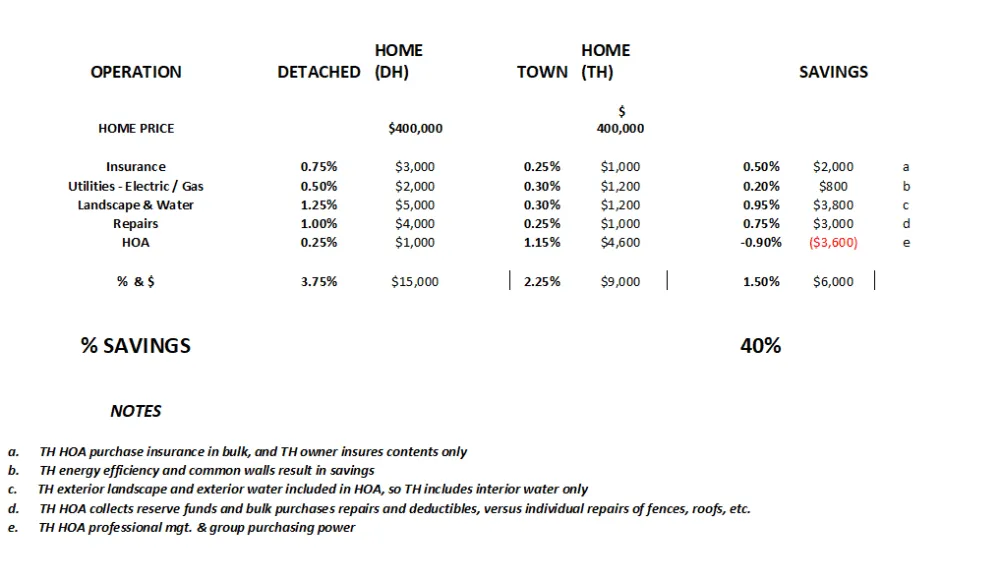

6.5% Mortgage rate too high- Prefer 5%? If you choose a DFW Townhome over a Detached Home, you save $9k annually (1.5%) so yo...

Stay updated with the latest news, tips, and stories from Grenadier Homes and the world of home living in the DFW area.

6.5% Mortgage rate too high- Prefer 5%? If you choose a DFW Townhome over a Detached Home, you save $9k annually (1.5%) so yo...

Dallas Fort Worth –Number 1 For the past thirty plus years ever since the Savings and Loan crisis in the late 1980s, Dallas/...

Past generations, The Silent Generation and the Baby Boomers, followed a more defined order of events before becoming first-t...

When is the Right Time to Buy a Home? Following skyrocketing demand for homes during the pandemic and climbing mortgage ra...

If you’re starting your DFW homebuying journey, it can be easy to get caught up in the emotional aspects of the process. Your...

As CEO of Grenadier Homes and a professional in the DFW real estate industry for 30 years, many of my friends have asked me w...

Advances in technology influence real estate in significant ways. The affordability and abundance of automotive technology in...

Are you one of the many moving to Texas? Did the big house or the new job or just the lower cost of living attract you to the...

When you decide on going to a restaurant, if you go for lunch or eat at happy hour, you save big versus the dinner menu. O...