If you want to live your best life, you should not buy your first home based upon the most house you can afford.

THE OLD WAY

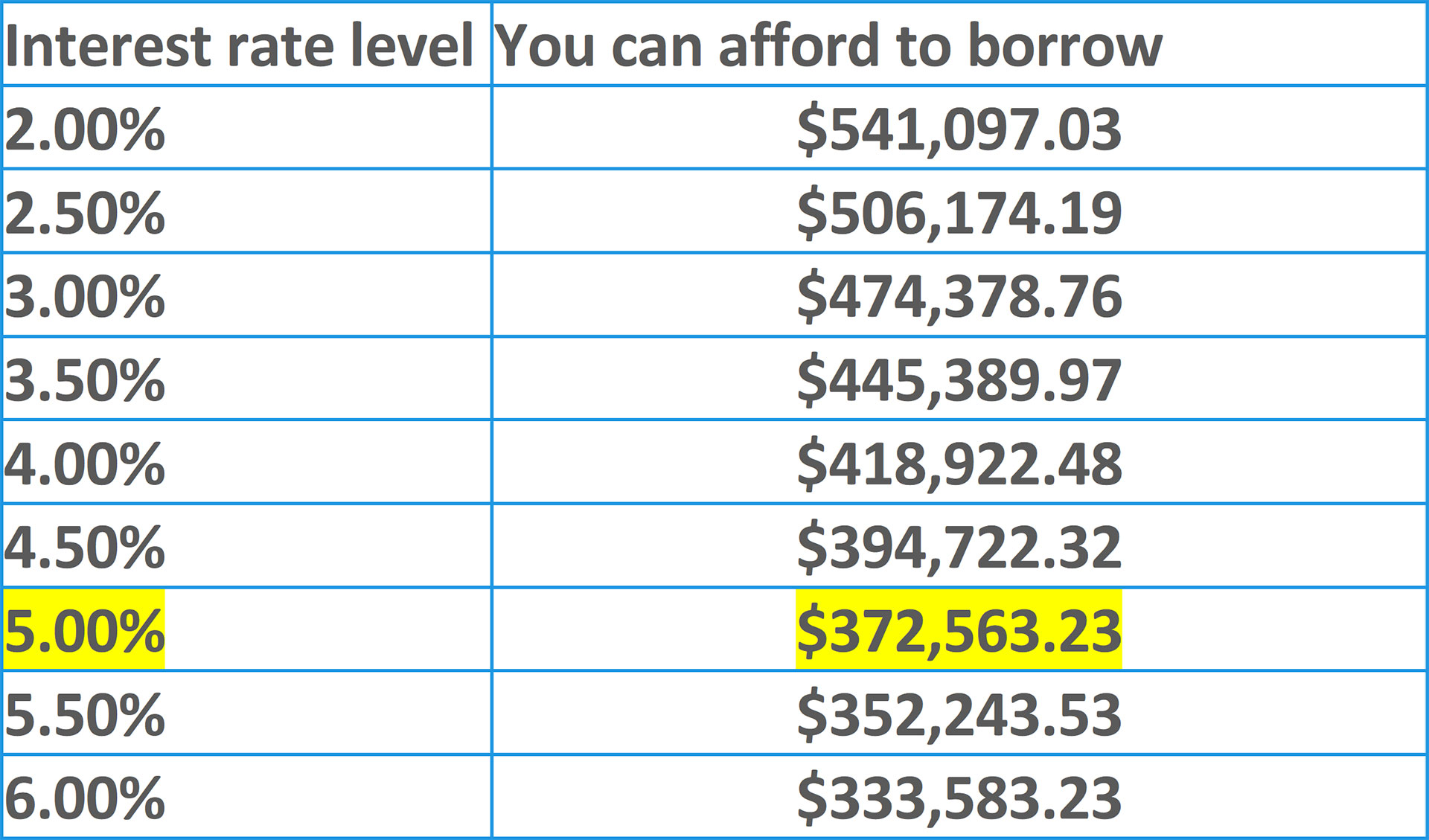

- Get pre-qualified for a loan of $372,000, based upon 5% interest rates, and approximately $6,000 per month income. (See Below)

- Find the largest home you think you may need in the $400,000 price range assuming a 10% down payment.

- Become house poor as all your income goes to necessities and not lifestyle items.

If you want to live your best life, do what a lifestyle coach would recommend and buy a home based upon the life you want to live!

If you spend one hour writing the following things down, you will not regret it. Everyone has shopped for groceries while hungry and without a list. How did that turn out?

THE BETTER WAY

- Develop a monthly lifestyle budget based upon how you want to live:

- Daily and weekend routine

- Job

- Commute (cost in terms of time and gas and car depreciation)

- Near to what: retail shops, restaurants, entertainment,

- Nearby amenities and nature (if they are not close, you will not use them often)

- Trips (getting away is very exciting and healthy)

- Create a Home Wishlist:

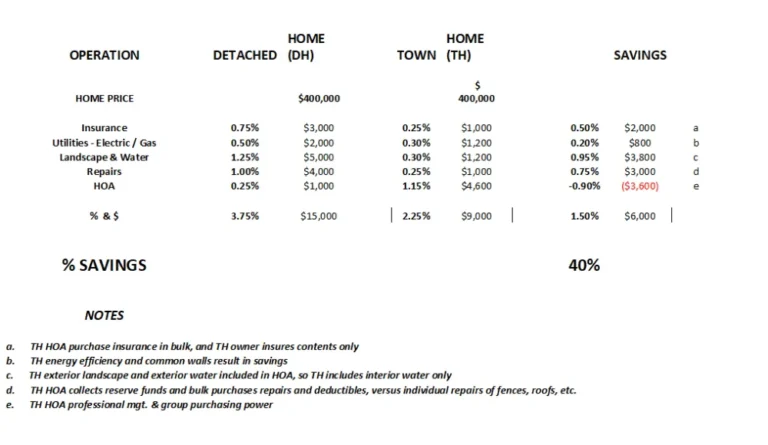

- Home Types – Attached homes and condominiums are very acceptable and will be very desirable going forward due to affordability.

- Home Size – Beds and Baths and Other areas needed.

- Outdoor Size – often overlooked are useable outdoor spaces, especially those that create community and curb appeal.

- Neighborhood Types – master-planned communities with shared amenities provide great lifestyle and investment benefits.

- Develop an Ownership Budget that includes ownership cost.

- Monthly cost to own – see my Happy Hour Home Blog. (Often overlooked is financial and lifestyle efficiency of attached HOA managed homes)

- Mortgage options: Choose from 30/15 yr., 10 yr. ARM, FHA, VA, lower down payment, etc.

- Develop an investment budget that includes your home budget.

- Down payment

- Closing costs

- Fixtures (Buyer upgrades to the home – can make a big difference)

- Furnishings (Models have 15%+ in the value of the home and this is why they look great)

The highlights in bold are critical and you should not overlook these. Most people who buy a home based upon what they can afford overlook these.

At Grenadier Homes, we specialize in homes that solve this lifestyle and affordability conundrum to allow you to live your best life.

This is why Grenadier Homes builds Townhomes, as they are a very intelligent, financially-savvy way to achieve a better lifestyle. Come see the 1-Story Villas and 2-Story Townhomes available at Mira Lagos in Grand Prairie, at Woodbridge in Wylie, and Windsong Ranch in Prosper. Grenadier builds premier lifestyle townhomes focused on community, outdoor courtyards, and terrific architectural styling. Located in master-planned communities, a Grenadier Townhome is a unique lifestyle option, and a smart financial investment, so you can live your best life.